Initially, cryptocurrencies were created with the lofty goal of giving money independence and anonymity, but it seems to me that they would have remained entertainment for a long time if not for the rise in the price of Bitcoin by thousands of percent in a few years. People paid attention to the crypto market and saw that there are plenty of opportunities for earning money - both with and without investments. Cryptocurrency has already become a part of our everyday life. For everyone to varying degrees: some have long been using crypto for personal and business purposes, some have only recently made their first crypto investment, and some are just beginning to understand how the market works and why it is needed at all. Earning money on cryptocurrency is relevant for all of the listed categories. The crypto market offers opportunities for users with different levels of knowledge and experience, initial capital and risk appetite.

Why does cryptocurrency remain a promising area for earning money? The digital asset market has experienced several growth and correction cycles, but retains potential. In 2025, regulation becomes a key factor: governments introduce clear rules, which reduces volatility and increases investor confidence. Cryptocurrencies are no longer associated only with anonymous transactions. Today, it is a full-fledged financial instrument integrated into the global economy. Earning on cryptocurrency is available even to those who start with a minimal budget, thanks to a variety of strategies - from passive staking (a method of passive income for storing cryptocurrency and supporting the network) to creating digital assets.

Cryptocurrency market trends in 2025

The main trend is the integration of blockchain (a highly secure data recording system) into the real sector. Companies are implementing smart contracts (blockchain programs that automatically fulfill specified transaction conditions) to automate logistics, and banks are launching cryptocurrency storage services. There is a growing demand for ecosystems with proof of stake (a method of protecting the blockchain, in which new blocks are created not by miners, but by coin owners): they are energy efficient and allow you to earn passively. Another growth driver is the development of decentralized finance (DeFi). Platforms for lending and earning on cryptocurrency are becoming more convenient for beginners. For example, services with automatic portfolio management strategies allow you to start investing even without deep knowledge.

How to make money on cryptocurrency? Current ways to make money on digital assets in 2025.

Trading on crypto exchanges

Many of you know the main rule of successful trading: buy cheaper, sell more expensive. This basic principle is used in any market: from stocks and precious metals to digital assets - cryptocurrencies, tokens, NFT. Earning on cryptocurrency due to high price volatility, the cryptocurrency market looks very attractive for traders, here you can earn a lot and quickly. In the example above, when buying 1 BTC, our earnings would be 64,000 - 50,000 = $ 14,000. Particularly bold traders additionally use leverage to increase the size of transactions due to cheap credit from the exchange. Such trading is called margin trading and its advantages are obvious - with 5x leverage, instead of 1 BTC, you can buy 5 BTC at once, in the example above, the profit from the transaction would also increase 5 times - from 14 to 70 thousand $!

You need to understand that when using leverage, the risks also increase. When buying Bitcoin on a regular basis, you risk about 50-70% of your investment (historical drawdown of the BTC/USDT rate), but no more. When using leverage, you can lose 100% of your investment with a small price movement due to a margin call - a forced closure of positions when the account drawdown is too large. Due to strong price fluctuations, this can happen quite quickly, so I do not recommend using leverage for beginner traders. How to make money on cryptocurrency - start trading cryptocurrency. There are many suitable platforms with more or less similar functionality, which allows you to find the most suitable option for each trader.

Earn on long-term cryptocurrency investing (HODL)

HODL is the easiest way to invest in cryptocurrency and one of the most popular options for investing money among beginners. The name is consonant with the English word hold, which means "to hold" and in meaning corresponds to the classic strategy "buy and forget". The crypto market has gained great popularity over 10 years and attracted more than a trillion dollars from investors, in the future this figure will clearly become even greater - the possibilities of passive investments are far from exhausted. It is worth buying the most popular promising cryptocurrencies with low risks by the standards of the crypto market. First of all, it is worth paying attention to the super-popular Bitcoin (BTC), as well as Ethereum (ETH) - the main cryptocurrency of smart contracts. The simplest and fairly reliable crypto portfolio looks like this: 50% BTC + 50% ETH.

Overview of popular altcoins:

Binance Coin (BNB) — the most popular exchange token

Cardano (ADA) — a blockchain with a scientific approach

Cosmos (ATOM) — a cryptocurrency with profitable staking

Dogecoin (DOGE) — the most popular memecoin

Litecoin (LTC) — a “lighter” version of Bitcoin

Near Protocol — a more modern analogue of Ethereum

Polkadot (DOT) — one of the largest Web3 projects

Solana (SOL) — the fastest cryptocurrency

Toncoin (TON) — a fast blockchain from the creators of Telegram

Tron (TRX) — a popular cryptocurrency for DeFi and stablecoins

Personally, I first added cryptocurrencies to my investment portfolio at the beginning of 2021. Their share does not exceed 10-15%, but this is more than enough for a complete experience due to high price volatility. Investing is the easiest way to make money on cryptocurrencies. All you need is to buy cryptocurrency and store it. For this, it is best to use a crypto wallet - the safest way to store digital assets.

Investing combines simplicity and high potential profitability, which is suitable even for beginners. But this method is long-term. Be prepared for the fact that the rate can be adjusted over a long period of time. If you are ready to store cryptocurrency for 3-5 years and wait for its rate to grow, then this method is right for you. For short-term and medium-term investors, the ability to understand fundamental analysis, as well as track trends, will be a plus.

How much can you earn? Depends on how cryptocurrencies grow and how patient the investor is. Let's calculate how much you could have earned if you invested in Bitcoin a year ago. Let's say on January 1, 2023, you bought 1 BTC for $16,500 excluding fees. In March 2024, the rate reached $73,737 and you decided to sell it. Your profit will be: 1 BTC * $73,737 - $16,500 = $57,237, excluding transaction fees. Over this period, the profit, regardless of the amount, would be +247%. In this case, to achieve the result, you would only need to perform two actions: buy and sell the asset.

Staking is a way to earn money on cryptocurrency

The first way to extract cryptocurrency was mining - the process of confirming new network blocks, as a result of which miners receive a reward. But every year this process requires more and more computing power and electricity. It was replaced by staking - the process of maintaining the operation of the blockchain for a reward, which does not require expensive equipment, electricity costs and long settings. To earn money, just buy cryptocurrency and freeze it at your wallet address for a while. Most crypto wallets support this option.

How much can you earn? Staking answers the question of how to make money on crypto for a beginner, because its profitability varies from 1% to 20% per annum and is not stable. Almost all PoS blockchains work on the same principle: the more crypto assets are staked, the more reward. And if the crypto asset rate grows, then the income from staking will become most noticeable. Also consider the compound interest. Let's calculate how much you could have earned if you had bought and staked Solana (SOL), one of the largest digital assets in the sector, at the beginning of 2023.

So, you bought 1004 SOL at $9.96 for $10,000. Solana staking yields 13% per annum. Let's say your validator, to whom you delegated coins, charges 10% of the profit. As a result, the yield for the year will be 11.7%. And this is without taking into account compound interest, with which the yield will be higher. Let's calculate how many SOL coins would have accumulated in a year:

1004 SOL * 11.7% = 1174 SOL

The price of the cryptocurrency in January 2024 was about $90. It turns out that the profit from investments and staking in total was:

1174 SOL * $90 - $10,000 = $95,660

Investments in Solana would have paid off almost 9.5 times. If you had simply invested in Solana without staking, you would have gotten $80,360 - $15,300 less. When calculating earnings, it is also worth considering the basic inflation of the cryptocurrency: it can "eat away" profits in the same way as the inflation of the national currency makes bank deposits unprofitable. For BNB, the real yield reaches 8% instead of 2%, and for SOL it is close to 0% instead of 7% as staking offers.

The most profitable thing is to be a validator and run a separate blockchain node. This requires professional skills and suitable equipment, here is an example for a BNB (Binance Coin) node:

processor with 16+ cores;

64 GB of RAM;

SSD with a capacity of 2+ TB;

connection from 250 Mbps.

You also need to contribute 10,000 BNB as collateral to staking, which is more than a million dollars. The conditions for other cryptocurrencies may be less stringent, but in any case, launching a full-fledged blockchain node is difficult and not suitable for everyone. For this reason, delegation is popular - sending cryptocurrency to one of the professional validators. Thanks to this mechanism, anyone can participate in staking directly through the blockchain, you just need to choose a validator and pay a commission of 5-10% of the profit received.

The commission is calculated from the APY interest rate and does not exceed 0.2% per annum in our example. This does not greatly affect your profit, and you do not need to do anything - the technical part is taken care of by the selected validator. It is worth staking cryptocurrency through hardware crypto wallets, which can safely store cryptocurrency for years. You can also use mobile crypto wallets (less secure) and cryptocurrency exchange accounts (no control over private keys). However, you need to understand that you will only receive high earnings from staking after several years of continuous delegation, so you need to be as confident as possible in the security of the chosen wallet.

Cryptocurrency mining

To support the operation of the Bitcoin network and other cryptocurrencies with the Proof-of-Work consensus algorithm, mining is necessary - the process of accounting for transactions and creating new blocks in the blockchain, which provides complete protection of information from hacking and fraud. Expensive equipment with high performance is used to solve complex mathematical problems embedded in the mining algorithm. Every few minutes, the blockchain allows one of all miners to add a new block to the database, he receives a good reward in cryptocurrency - this allows you to recoup the costs of the equipment. The higher the power of the equipment, the greater the chance to earn!

In theory, you can mine even on your phone, but the income from this will be negligible, so the following options are used:

Mining on a PC is an option available to everyone, for which you can use home appliances and not invest in more expensive equipment. It is effective only for earning on new promising cryptocurrencies with low competition, you will not be able to earn on Bitcoin or Ethereum.

Mining on video cards is the creation of so-called "mining farms" that combine several video cards. The output power is significantly higher than that of a PC, which already allows you to earn money on ether.

ASIC mining is the use of chips specialized for a specific hashing algorithm, which allows you to get the highest power. There are no limits for earnings, the only question is the number of such chips.

Industrial mining is the creation of special data processing centers similar to data centers of IT companies. You need a room with an uninterrupted supply of electricity, constant cooling and security.

There is an option for making money without investing in equipment - the so-called cloud mining, where the "hardware" is rented from the owner of an industrial farm. Income depends on the power of the equipment, but already taking into account the rent, so there is a chance of getting a loss.

The first cryptocurrencies, such as Bitcoin, can be mined using special equipment. But for tangible profits, considerable investments will be required, which will go towards purchasing equipment and paying for electricity. Mining efficiency will also depend on the country. So in August 2023, analysts from CoinGecko calculated the cost of mining 1 BTC in different countries for lone miners. In Lebanon, BTC can be mined for only $260, while in Italy for $208,600. And, for example, in Ukraine, the price of mining was 10.73 thousand dollars. In addition, the equipment becomes obsolete and its efficiency decreases over time, which affects profitability. There are two types of mining: cloud or using your own equipment. Let's briefly consider both options.

Classic mining. This option is more difficult, since it requires setting up equipment and installing software. In addition, you need to maintain the equipment so that it functions as long as possible: provide uninterrupted power and a high level of cooling. But there are hosting services: you only buy equipment and pay rent, and specialists do the setup and maintenance. However, the costs in this case will be higher.

Cloud mining. This process is completely passive. You purchase cloud contracts and receive income from mining by paying a commission for electricity. The advantage of cloud mining is that you do not need to purchase the entire equipment - to start a contract, it is enough to pay a minimum hashrate, which costs between $10-$20 depending on the service. The disadvantage of cloud mining compared to classic mining is that in the case of negative profitability, payments stop coming in, and the rent may not pay off. If you mine on your equipment, you will incur losses, but coins will continue to be mined, and the equipment will pay off. How much can you earn? Mining profitability depends on the cryptocurrency rate and mining complexity, as well as the cost of electricity. The higher the complexity and the lower the cryptocurrency rate, the lower the income. You can calculate the approximate profitability using mining calculators. The Bitcoin rate began 2024 at $42,360, under such conditions, BTC mining brings good profit. It is important to correctly calculate the cost of the farm, the price of electricity, the payback period of the equipment depending on the current rate. It is also important to take into account the dynamics of mining complexity. In 2025, the reward for creating a new network block is 6.25 BTC or ~$165,000.

Buying/Selling NFT DeFi Projects

Investing in the developing DeFi sector or NFT tokens will be a great addition to a classic cryptocurrency portfolio:

DeFi is a decentralized financial system, an alternative to the banking sector. Large decentralized projects, such as the Uniswap exchange, issue their own tokens that you can invest in;

NFTs are non-fungible tokens that have launched a wave of digital art. Many famous people, artists, and large companies release their collections. Their value can grow by hundreds of percent in a short period of time.

How much can you earn? During the bull market, the price of popular DeFi platform tokens increased several times. Some of them have grown by several thousand percent in just a month. For example, the Yearn.Finance token (YFI) has grown in price by more than 30,000%, and for some time its rate even exceeded the Bitcoin rate.

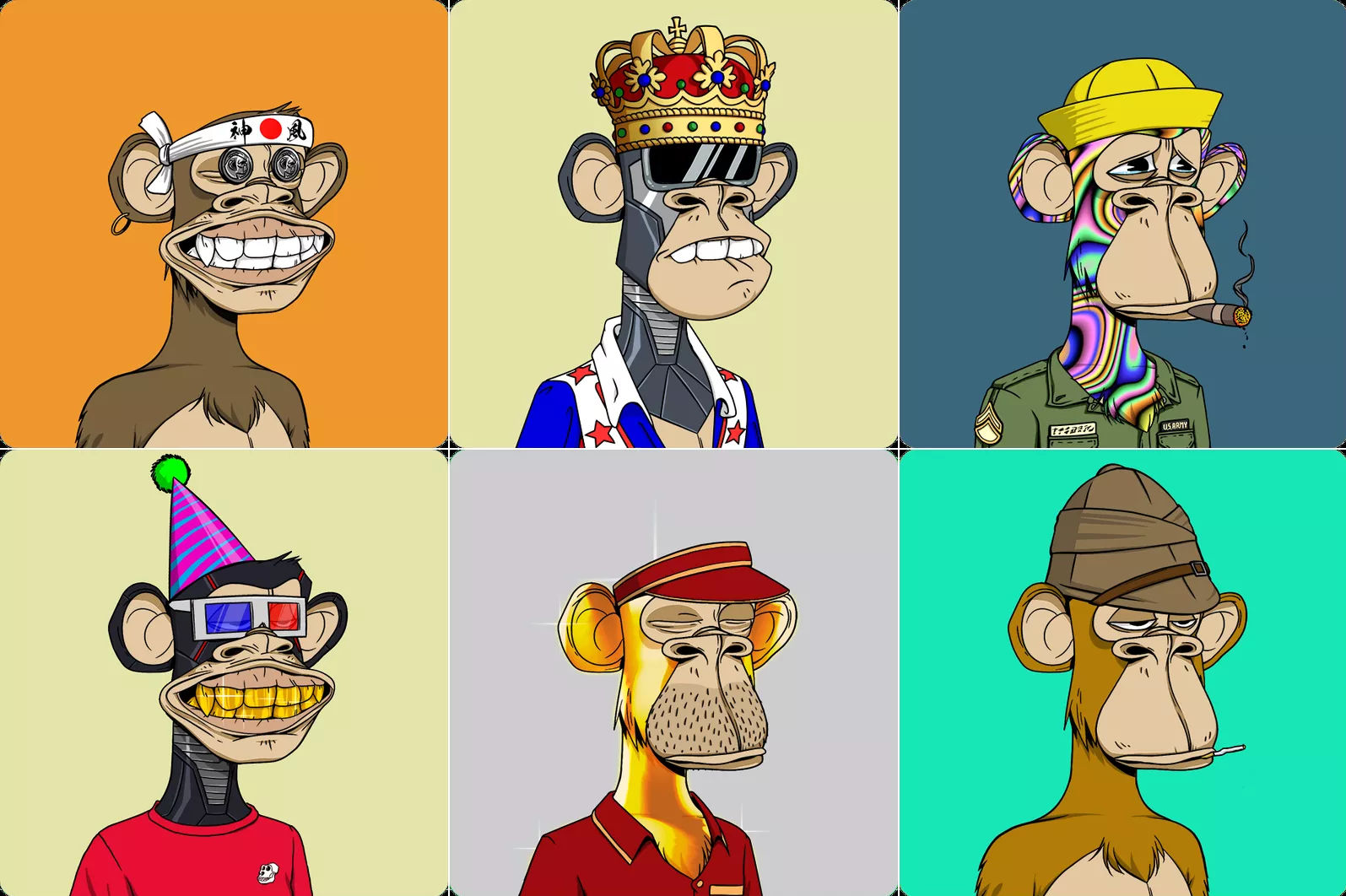

In 2021, NFT (non-fungible token) was named the word of the year by the Collins English Dictionary. NFT is a digital certificate in the blockchain that guarantees exclusive ownership of a virtual object. The hype around the three funny letters continues to this day, with famous people (for example, Cristiano Ronaldo) regularly releasing new collections. Their price is constantly changing, which allows you to earn money by buying/selling tokens.

There are several types of non-fungible tokens:

art tokens - images and art objects;

game tokens - various items in NFT games;

smart tokens - other valuable digital assets (for example, domain names).

You can use different cryptocurrencies to buy NFT, but in 90% of cases, Ethereum or one of the second-level tokens (MATIC, OP, ARB) is used. If you want, you can create your own token and sell it, although without a well-known brand, it will be difficult to get a good price.

Earning crypto by creating content for social networks

On some websites on the Internet, you can earn cryptocurrency for writing articles or creating videos. Payment is most often in the form of internal tokens of the site, which can then be sold on the exchange or exchanged for another cryptocurrency. Here are some of them:

steemit is a blockchain-based social network where anyone can earn money on their content in the STEEM cryptocurrency. The more votes (likes) for an article, the higher the income can be. You can also vote for someone else's content in the early stages of voting - if it takes off, you will also receive cryptocurrency. The most popular posts on the platform are valued at tens of thousands of dollars.

publish0x is a blockchain-based media platform where you can earn AMPL and FARM cryptocurrency by creating content, as well as reading and commenting on other people's articles. Here it is not necessary to write about cryptocurrencies, any content is welcome.

lbry - the platform positions itself as the first decentralized marketplace for digital content. Mostly videos, so LBRY can be called an analogue of YouTube. If users like your content, they will pay in LBC cryptocurrency.

It is worth saying that all these sites cannot even come close to competing with the IT giants that dominate the content market today. Income in cryptocurrency can hardly be compared with income from the YouTube affiliate program, advertising on Instagram or Telegram, but the competition on blockchain content platforms is much lower and it is easier to become a local "star" there.

Earning on memecoins

Memcoins are cryptocurrencies created on the basis of popular internet memes or jokes, which, thanks to the support of the community, can show significant growth in capitalization. In 2024, memecoins became one of the main trends in the cryptocurrency market. Dogecoin, the most famous memecoin, reached seventh place among all cryptocurrencies with a capitalization of $ 56.9 billion, demonstrating growth of 405.5% in a year. At the beginning of the year, Dogecoin was trading at $ 0.091, and in December it reached a historical maximum of $ 0.46. Elon Musk played a significant role in the popularization of Dogecoin, who repeatedly supported the token.

Another example of success is Shiba Inu (SHIBA), which took 15th place in capitalization ($ 15.2 billion) and grew by about 210% since the beginning of 2024. Overall, The Block's GMCI MEME index, which tracks the most popular memecoins, has grown by 398.63% year-over-year, confirming that interest in this segment continues to grow. In 2025, the memecoin trend remains relevant. The $TRUMP memecoin, created on January 17 before the inauguration of the new US president, attracted special attention. In just three days, its capitalization reached $9 billion, making its first investors millionaires. This case demonstrates how memecoins remain high-risk, but potentially super-profitable investments.

Memecoin Earning Strategies:

Early-stage investing. Buying memecoins immediately after launch can provide high profits if the project gains popularity.

Speculating on volatility. Due to sharp price fluctuations, traders can make a profit using short-term strategies.

Trend analysis. Follow news, social media, and influencer activity that may drive the growth of a particular memocoin.

Portfolio diversification. Investing in multiple memocoins reduces the risks associated with the collapse of a single project.

Creating your own cryptocurrency

There are thousands of cryptocurrencies/tokens today, and you can create another one if you want. There are several options:

Create a cryptocurrency from scratch. The most difficult way, which requires a team of experienced blockchain developers and a lot of money - it may take several years to bring the project to mind and make it competitive.

Take another cryptocurrency as a basis. You take the code of one cryptocurrency, refine it and add new features. For example, there are several dozen Bitcoin variants, although they are nowhere near as popular as the first cryptocurrency. Usually, special platforms are used to create such coins, which provide the main blocks of cryptocurrency code in a ready-made form.

The main problem with making money on your cryptocurrency is how to make people buy it so that it grows in price. Some developers simply buy advertising, where they promise hundreds of percent profit, conduct an ICO, sell the coins they own and successfully abandon the project. To make a long-term successful cryptocurrency, you need to offer the market something interesting: a new way to make money, a new technology, a solution to current blockchain problems.

Examples of platforms where you can create your own cryptocurrencies:

Github is a place where open source projects are developed;

Ethereum is a platform where thousands of blockchain project tokens have been created;

The World Exchange is a platform from Ripple with the ability to create tokens.

Referral programs with crypto earnings

If you have friends or acquaintances who are interested in cryptocurrencies, you should take part in crypto exchange referral programs and receive up to 50% or more commissions from transactions of attracted clients. Affiliate programs work best where you can offer users some kind of bonus - in the example above, users receive a 20% discount on spot trading commissions. For active traders, such a welcome bonus will definitely not be superfluous - they will specifically register using such a link. For owners of blogs, websites and social accounts with high traffic, exchanges offer affiliate programs with an increased referral percentage. To get into them, you need to submit an application and communicate with an exchange representative to register in a professional affiliate system. In addition to increased earnings, you will be able to receive a budget for trading contests, be aware of all marketing offers and communicate with a personal agent to resolve various issues.

Cryptocurrency exchanges, wallets, merchants and other cryptocurrency services offer users to become members of an affiliate program and earn income in cryptocurrencies by inviting clients. The advantage of this method is the ability to earn on cryptocurrency without investments and risks, without even understanding the field. When you download the wallet, you receive a special affiliate link. When users register using it, they become your referrals.

Distribute the link in any legal way: send it to friends in a message, publish it on social networks or forums, and so on. If you have your own blog or website, you can promote the link through it. Often, even motivated traffic is encouraged, since the services will make a profit in any case. When a user registers using your link and makes a purchase, sale or exchange, you receive income for each of their transactions.

How much can you earn? In short - from zero to infinity. It all depends on how much the company pays, how many referrals you attracted and what their turnover is. Some companies are ready to pay 20% of the profit, others - up to 50%. Let's give a simple example. You invited 1,000 people, each of whom sells and buys cryptocurrency for $1,000 per month on average. The service pays up to 45% of its income for each transaction. In this case, in a month you will earn: 1,000 people * $1,000 * 45% = 4,500 USDT

Earning crypto without investment: faucets, airdrops and bounties

A cryptocurrency faucet is a service for earning cryptocurrency without investment, where you can receive rewards in cryptocurrency for solving captchas and other simple tasks. You can simply visit the site every few minutes and receive a small amount of BTC, ETH, USDT and other coins of your choice. To receive a tangible amount, it is worth registering on several sites and completing tasks with the best income/time ratio. It also makes sense to withdraw earnings in cryptocurrencies with good growth potential. This method of earning is suitable for those who have free time and patience to repeat monotonous actions.

It is not necessary to invest your funds in cryptocurrencies: you can participate in distributions and receive coins or tokens for free by performing simple actions: subscriptions, likes, reposts, content creation. You can receive a reward for each action performed. The more complex the action, the greater the reward. For example, a repost is usually valued much more than a subscription. In addition, the more subscribers you have, the greater the reward can be. Sometimes airdrop creators launch referral competitions, for winning which you can get an impressive amount of tokens. Or they launch puzzles - for example, in 2023, Yaga Labs launched a series of weekly quests with a prize of 0.12 BTC.

The conditions and requirements for bounty participants are higher, but you can also earn more than on airdrops. The risk of airdrops and bounties is that you can waste time and not earn anything if the project whose tokens are distributed to users does not develop, and the tokens themselves do not appear on any exchange. Therefore, the profitability varies from zero to tens of thousands of dollars from one distribution. For example, the Uniswap project distributed 400 UNI to each user who made at least one confirmed transaction on the platform. At the time of the distribution, these tokens were worth about $ 1,300. If you had received them and sold them a year after the drop, you could have earned ~$11,000 for a simple exchange. Of course, there are more unsuccessful examples of project launches, not to mention the high activity of fraudulent projects. However, with proper fundamental analysis of the project, you can find really worthwhile assets, such as UNI or 1INCH.

New crypto projects need advertising to attract the attention of the community. One of the most effective ways to do this is to arrange a free distribution of tokens. Airdrop is a marketing strategy in which users are given cryptocurrency or NFT for completing simple tasks: subscribing to social networks, putting a like, reposting from official pages, etc. Airdrops are held quite often, they can be tracked on sites like Airdrops. Such a promotion strategy does not hit the developers' budget, because new cryptocurrencies are usually not worth anything yet. Users earn tokens for the future, over time they can grow by thousands of percent if the project is successful. However, they can also depreciate to zero if the token does not take off - but since everything is free, no one complains much.

In addition to Airdrops, where you can earn in a couple of clicks, blockchain projects conduct more demanding and profitable Bounty programs for participants. The term comes from the computer games industry, where it is the name of a campaign to attract players and specialists to work on projects - for example, to find bugs. To receive a reward, you will have to report to Bounty managers, so the work must be done efficiently and on time. Each project sets its own rules and frequency of reporting, so carefully study all the conditions before participating. Sometimes reports are accepted automatically in special programs.

The amount of the reward depends on the number of participants and the work done. For each completed task, you earn stakes - a share of the general fund of the Bounty program. The price of the stake will be determined at the end, when the manager calculates the total amount of work done by all participants. The payment period may vary, up to several months. There is also a risk of running into scammers, as always.